WRI Co-hosts International Roundtable on Green Development Guidance for BRI Projects

BEIJING (April 13, 2022)- The World Resources Institute (WRI) co-hosted an international multi-stakeholder roundtable on Green Development Guidance (GDG) for BRI projects to further expedite the GDG’s applications in green finance and renewable energy and other green infrastructure projects, sharing the project team’s workplan for discussion.

With the current dual challenge of the epidemic and the climate crisis still running rampant, the world is further solidifying its consensus on the green and low-carbon development. Led by the BRI International Green Development Coalition (BRIGC) and with support from WRI, the Children’s Investment Fund Foundation (CIFF), and ClientEarth, the event brought together over 80 participants from the Ministry of Ecology and Environment (MEE), the Ministry of Finance (MOF), China Banking and Insurance Regulatory Commission (CBIRC), governments of BRI countries, financial institutions, enterprises, environmental and research institutes for discussions on green finance for BRI projects.

International Roundtable on Green Development Guidance for BRI projects

In the opening session, Li Yonghong, the deputy director general of Foreign Environmental Cooperation Center (FECO) of MEE, congratulated the team on the GDG project’s success in the past two phases, particularly on its support to guide the greening of BRI. Erik Solheim, the BRIGC Advisory Committee convener and WRI senior advisor highlighted China’s efforts in delivering the Paris Agreement target. He emphasized the role of BRIGC in the GDG project and underlined the investment potential following the Guidance on Jointly Developing the Green BRI recently issued by four ministries. Guo Jing, the president of BRI Green Development Institute acknowledged the role GDG project played in informing decision-making, including providing strong backing to China’s recent decision regarding coal projects overseas and guidance to accelerate green investment in BRI countries, and encouraged the team to further strengthen platform-building, research cooperation, and on-the-ground implementation of the GDG.

The keynote speeches focused on the progress and plans of the GDG project. Zhu Yuan, associate director specialist from BRIGC Secretariat, presented this year’s workplan on both in-deep analysis of investment cases, and technical guidance for solar power investments. Christoph Nedopil, associate professor and director of Green Finance & Development Center at Fudan University, introduced GDG’s innovations in incorporating environmental dimensions, leveraging current policies, and valuing the local considerations among others, and proposed an outlook on increased green investment and reduced red projects in BRI.

From left: Li Yonghong, Erik Solheim, Guo Jing, Zhu Yuan, Christoph Nedopil

Panel Discussion I: National Practices of Green Finance in BRI Countries

The first panel discussion moderated by Zhang Jianyu, executive president of BRI Green Development Institute, centered on national practices of green finance in BRI countries. From the perspective of financial regulators and institutions, Xie Fei, chief technical advisor to China Public Private Partnerships Center of MOF, pointed out that enterprises are the major players in BRI investment and development, therefore should take a leading role in greening the BRI following the requirements and principles of the four ministry’s joint Guidance. Wang Qingrong, director of Strategic Research Division of the Policy Research Bureau of CBIRC, noted that CBIRC actively supports the green development of BRI and is currently guiding financial institutions to accelerate divesting from carbon-intensive assets and providing preferential financing to clean energy projects. Zhuo Yong, deputy general manager of the Credit Approval Management Department of the China Export & Credit Insurance Corporation (SINOSURE), member of China’s Office of the Leading Group for Promoting the BRI, shared the company’s experiment of a differentiated underwriting policy this year to strictly limit insurance underwriting for projects associated with carbon-intensity or energy-intensive industries, highlighting that SINOSURE will no longer provide support for new coal power projects abroad.

From left: Xie Fei, Zhang Jianyu, Wang Qingrong, Zhuo Yong

Among representatives from BRI host countries, Batjargal Zamba, special envoy of Mongolia on climate change, introduced Mongolia’s National Sustainable Finance Roadmap established this year, and its plan for growing to a knowledge hub of sustainable finance in the region by 2025. Sara Jane Ahmed, finance advisor to Vulnerable Group of Twenty (V20) Ministers of Finance of the Climate Vulnerable Forum, shared the progress of the V20-led Climate Prosperity Plan, and proposed potential synergy between the V20 and BRI, particularly in strengthening climate-related economic partnerships between international investors such as China and the V20 members.

Representatives of international and domestic institutions with work on the BRI also joined the discussion. Liu Qiang, Director of Programmes for China, Children’s Investment Fund Foundation, said that with the global climate-change crisis looming large and COVID continuing to impact the economy and society, it is suggested that China should give full play to its competitive edge in renewable energy, enhance pragmatic cooperation with BRI countries on the low-carbon transition, and incentivize financial institutions to further support climate-friendly projects. Dimitri De Boer, chief representative of ClientEarth China, highlighted the urgency to strengthen practical cooperation with BRI countries in developing a green project list that reflects local needs while working to phase out high-carbon projects. Wang Jiujuan, deputy general manager of International Cooperation Department at the Belt and Road Environmental Technology Exchange and Transfer Center (Shenzhen) introduced their work on international cooperation on green finance and climate change, including experiments in launching dedicated investment facilities such as climate fund of funds (FOF) and secondaries.

From left: Batjargal Zamba, Sara Jane Ahmed, Liu Qiang, Dimitri De Boer, Wang Jiujuan

Panel Discussion II : Financing Sustainable Development in BRI countries

The second panel session focused on financing sustainable and low-carbon energy in BRI countries. Fang Li, moderator of the panel and chief representative of the WRI China Office highlighted China’s recent pledge in the 76th UNGA to step up support for developing countries in developing green and low-carbon energy. To that end, the GDG project needs to explore ways to further support BRI investment in green projects, especially those based on renewable energy. Further progress in the GDG project will depend on closer cooperation and innovative practices among all stakeholders.

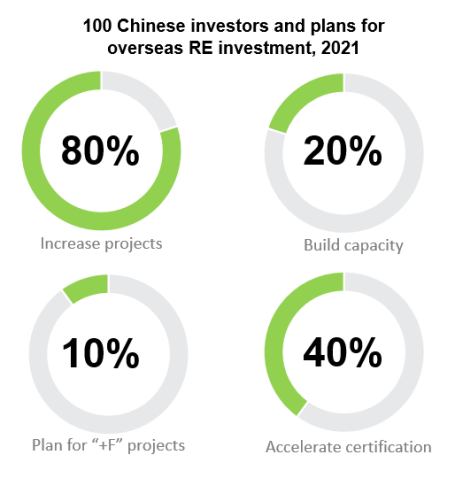

During the panel discussion, Wang Ye, research associate of the Finance Center and Sustainable Investment Program, shared the research and findings of WRI’s BRI work. Analyzing the global renewable energy financing landscape and trend , she noted a number of challenges hindering China’s renewable investment in BRI countries, despite increased investor interest. One prominent obstacle was the high cost to finance renewable projects due to insufficient information for risk assessment, resulting in the rare flow of global renewable finance to countries and regions suffering the most from poverty and the lack of access to electricity. Actions were proposed to increase information-sharing and investment-facilitating service, and to explore solutions of integration and aggregation at capital, investor and project levels, and the use of de-risking tools by public funding to leverage more private capital.

Source:New Energy Investment Alliance and WRI

From the perspective of financial institutions, Li Xiaowei, deputy director of the BRI Research Institute at China Eximbank, noted that Chinese banks constantly lack quantitative assessment of the climate impact on their asset portfolios, and, in renewable energy projects, face a high degree of uncertainty in terms of costs and benefits, and the problem of information discrepancy among stakeholders. Suggestions on green standards, carbon reduction pathway in financial institutions, and information disclosure from borrowers were proposed.

Yin Hong, vice president of the Modern Finance Research Institute of the Industrial and Commercial Bank of China (ICBC), pointed out the lack of data and models to identify and manage environmental risks and a clear methodology to measure environmental footprint by the banking sector. Opportunities were highlighted for financial institutions to strengthen international cooperation, benchmark to international standards and stay abreast of policy signals and market changes.

From left: Fang Li, Wang Ye, Li Xiaowei, Yin Hong

Fang Yongbing, general manager for the International Business Department of the PICC Reinsurance Company, echoed the challenge of the lack of data and information disclosure in the insurance industry and on the part of the insured entities, pointing to the sometimes-inconsistent standards, and the various local contexts among BRI countries that also hamper insurers’ climate and environment-related risk management. To overcoming such barriers, companies with the necessary wherewithal should play leading roles in disclosing climate-related information, pushing for harmonized standards, and setting low-carbon development targets.

Among panelists from the BRI project host countries and international organizations, Mustafa Hyder Sayed, executive director of Pakistan-China Institute stressed that commercial viability is crucial for policy on promoting green projects in developing countries. While emphasizing state-owned enterprises’ role in scaling up renewable development, he also suggested that China and other major international investors should help enhance the capacity of local financial institutions via deeper collaboration.

Saliem Fakir, executive director for the Africa Climate Foundation, projected a decreasing cost of technology and financing for renewable and power transmission, as more public and private capital would be leveraged by the China-Africa collaboration on climate change and energy transition.

Dean Cooper, the WWF Global Transition Lead, suggested that local governments should provide more policy support and a stable investment environment to help the private sector reduce investment costs, while paying sufficient attention to balance renewable development and biodiversity protection when planning and managing projects.

From left: Fang Yongbing, Mustafa Hyder Sayed, Saliem Fakir, Dean Cooper

Concluding the roundtable, Erik Solheim set high expectations for the GDG project, encouraging the team to continue and expedite its work to meet the urgent demand of green finance, particularly the financing for renewable energies, which has been underscored by the uncertainties and complexity caused by the pandemic and international relations.

Background Information

The BRIGC is an international platform jointly launched by the Ministry of Ecology and Environment (MEE) and Chinese and international partners at the Second Belt and Road Forum for International Cooperation in April 2019, with an aim to enhance international consensus, understanding, cooperation and concerted action on BRI green development. The World Resources Institute is a BRIGC member and co-leads two thematic partnerships in green finance and investment, and green cities.

To better support the high-quality development of the BRI with green finance, and to coordinate the global sustainable development of the BRI, the BRI International Green Development Coalition (BRIGC) launched the Joint Research Project on Green Development Guidance for BRI Projects (GDG) in 2019 and released the Phase I baseline study. The research set out to develop a project classification system based on the eco-environmental and climate impacts, together with a set of clear and operable guidelines, helping providing green solutions and inform the decision-making of a range of stakeholders engaged in BRI projects.

The GDG Phase-I baseline study was launched in December 2020, The providing nine recommendations for greening the BRI and a classification system – the traffic light system – evaluating climate, pollution and biodiversity impacts of investments.

The GDG Phase-II study, Application Guide for Enterprises and Financial Institutions, was launched in December 2021. The study aims to develop a set of application guidelines and basic tools for identifying, assessing, managing and improving environmental performances of BRI projects for financial institutions, enterprises and other stakeholders. It is also intended to enhance the alignment of sustainable-development standards and demand on the one hand, and the internal management strategy, rules and corporate structures of stakeholders on the other hand, formulating technical guidelines for transportation infrastructure, including railways and highways, as the key sector, with a view to helping boost the green development of BRI projects.