Distributed Solar PV in China: Growth and Challenges

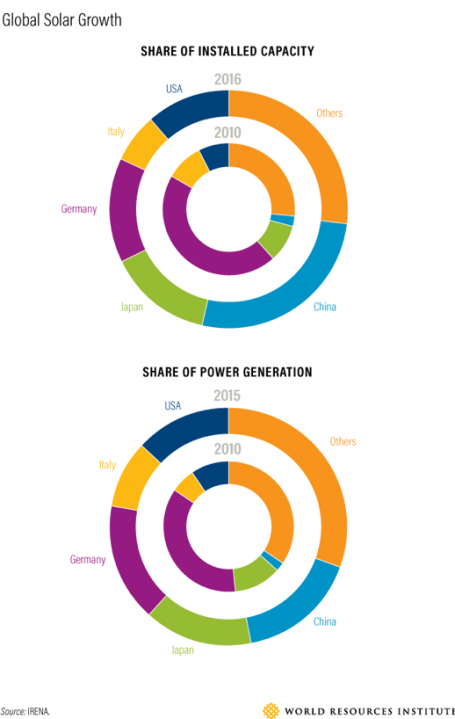

Solar photo-voltaic (PV) installations have boomed globally since 2010, with an annual growth rate of 40 percent. China is leading that growth: it ranks first since 2015 in both installed capacity and power generation.

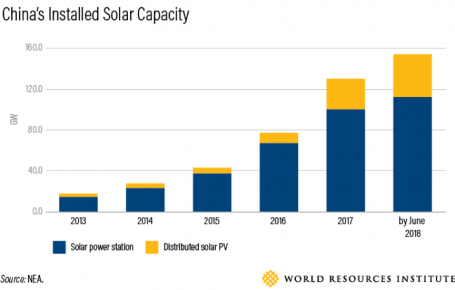

By 2017, China had 130 gigawatts of solar PV to the grid—nearly six times the capacity of the Three Gorges hydroelectric plant, the largest in the world. Furthermore, the nation achieved its 2020 goal for solar two years ahead of schedule.

In China, distributed solar PV is growing remarkably faster than large-scale solar power stations. (Distributed refers to smaller solar power generation facilities that are located close to consumers and connected to distribution systems, with access voltage below 35 kilovolts.) China’s new installed capacity of distributed solar PV in 2017 was 19.4 gigawatts—3.6 times higher than it was just a year before. Distributed solar PV generated 13.7 terawatt-hours of electricity in 2017, enough to power all the households in Beijing for 7.5 months. The accumulated installed capacity of distributed solar PV now accounts for 27.1 percent of China’s total solar PV installation.

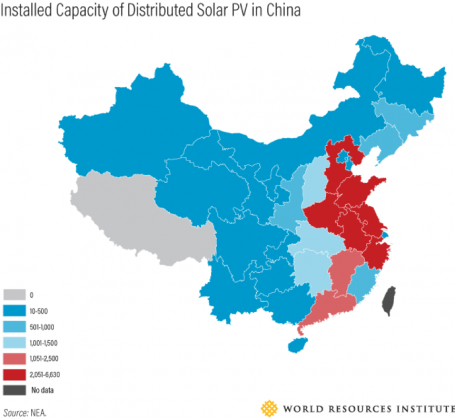

Distributed solar PV has been installed mainly in east and south China, where the country’s economy is most prosperous and demand for power is greatest. About 52 percent of capacity is in four provinces: Zhejiang, Shandong, Jiangsu and Anhui.

There are four main reasons that distributed solar PV is growing faster than ever:

1. National Targets

According to the 13th Five Year Plan of Solar Power Development, issued in 2016, at least 60 gigawatts of distributed solar PV will be installed by 2020, at a rate of 10 gigawatts of capacity each year. Over the same period, 100 demonstration zones of distributed solar PV will be constructed, with 80 percent of new building rooftops and 50 percent of existing building rooftops equipped with distributed solar PV systems. In addition, China launched a Solar PV for Poverty Alleviation Program in 2014, which supports a large share (70-80 percent) of the initial investment and allows families to use power freely or sell it to the grid.

2. Incentive Policies

To achieve its national targets, China has issued a series of incentive policies since 2013 that covers both national and sub-national levels. The most influential of these provides a growth in subsidies for distributed PV solar systems.

In addition to the national solar subsidy, now 0.32 Yuan ($0.049) per kilowatt-hour (kWh), local governments—10 provinces/municipalities, 36 prefecture-level cities and 10 county-level cities/regions—have their own subsidy policies for distributed solar PV projects. Many of these areas produce solar panels locally and have their own targets in place for renewable energy expansion. Subsidy rates and duration vary from region to region; local subsidy rates range from 0.05 to 0.55 Yuan/kWh (USD 0.0077-0.0846/kWh), lasting from 2-20 years.

Tax incentives for both solar stations and distributed solar generation are also driving expanded distributed solar PV domestically. These incentives, coupled with the long-term durability of solar PV systems, make them an attractive investment for project developers.

3. Declining Cost and Improved Efficiency

Declining costs also make distributed solar PV projects more attractive for private companies. The average price of global PV modules decreased by 79 percent from 2010 to 2017; at the same time, technological improvements led to significant increases in efficiency. Influenced by these factors, the average cost of solar power generated in China in 2017 was about 0.5 Yuan/kWh (USD 0.077/kWh), a 75 percent drop from 2010. The continuous decline in cost has attracted more companies to invest in distributed solar projects.

4. Profitable business models

China’s electricity rates for industry and commerce are much higher than those for households. Thus, if businesses install distributed solar PV to generate power for themselves, they can achieve considerable savings. Other diversified applications are emerging, too. “Solar PV+”, or solar PV integrated with agriculture, solar PV fisheries and solar PV livestock operations show the potential ahead.

Trends to Watch

Despite the remarkable success of China’s solar policies, recent updates have brought huge uncertainty about whether distributed solar PV projects will continue to boom.

As the cost of solar PV keeps falling, China is accelerating reductions in subsidies for solar PV projects. Since January, the national subsidy rate for distributed solar PV projects has been cut twice; it is now set at 0.32 Yuan/kWh (USD 0.049/kWh), 0.1Yuan/kWh (USD 0.015/kWh) less than the previous subsidy. Meanwhile, although only about 10 gigawatts of distributed solar PV projects will be subsidized by the government through 2018, 12.2 gigawatts has already been installed in the first half of the year.

In light of the new situation, distributed solar PV project developers may have three options: 1) Rely on existing local subsidies. However, these may expire in coming years, and it is not clear whether they will be extended. 2) Wait for next year’s quota of national subsidies, which have not been announced yet. 3) Develop projects without subsidies.

New pilot programs may offer opportunities amid the challenges. National Energy Administration (NEA) initiated a pilot program on peer-to-peer trading of distributed generation, which could be a win-win for both power producers and consumers. Three modes were proposed for the pilot: direct sales, in which generators sell distributed power directly to consumers and pay a dispatch fee to grid companies; entrust sales, whereby grid companies sell distributed power to consumers on behalf of generators; and sales to grid, in which generators sell power to grid companies at the same rates as feed-in tariffs for local, large-scale solar power stations.

Because peer-to-peer trading will encroach on the conventional business of grid companies and reduce their revenue and profit, grid companies are reluctant to support the pilots. However, as they transition to become integrated energy service providers, grid companies could invest in distributed solar PV projects through their own subsidiary energy service companies. This path could hold the most potential to keep distributed solar PV projects growing.